Guided Investing

In 2019, Merrill tasked us with developing an online account opening flow. They aimed to attract new and hesitant investors, avoiding the need for advisor conversations. The flow would allow users to open and manage accounts like IRAs and personal investing accounts.

My team at S&P Global specialized in creating investment tools for top banks, with a particular emphasis in algorithm-driven AI investing.

My role

Content and product design

Added to the design system

Revamped existing screens in onboarding flow

Redesigned summary screen

Constraints

Legal

Time

Development effort

Existing design system and brand

Rituals

Daily stand-up

Workshops once a week, designers rotated who ran them

Crit once a day, designers rotated who presented

Client presentations twice a week, designers rotated who presented

User interviews twice monthly

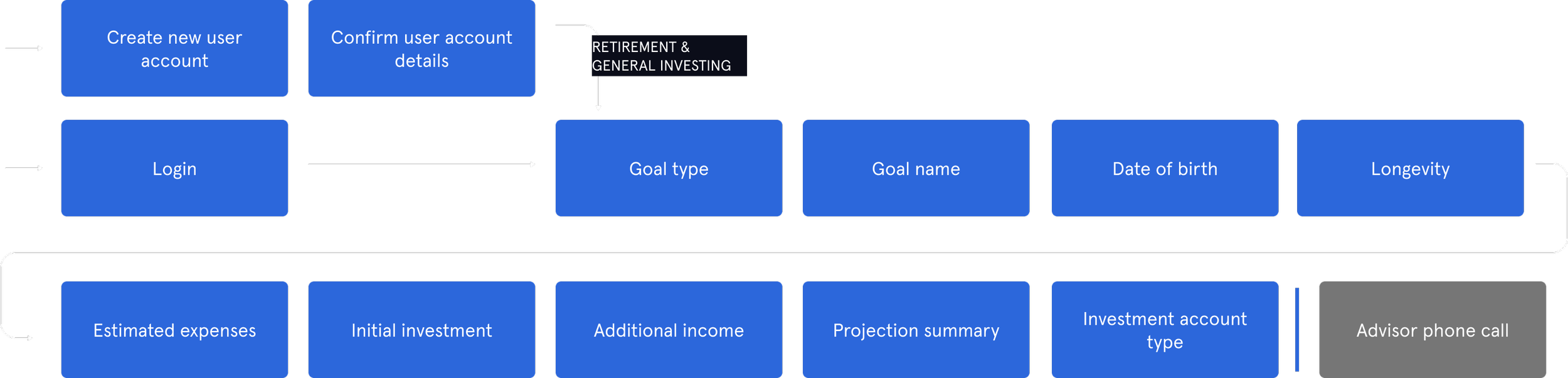

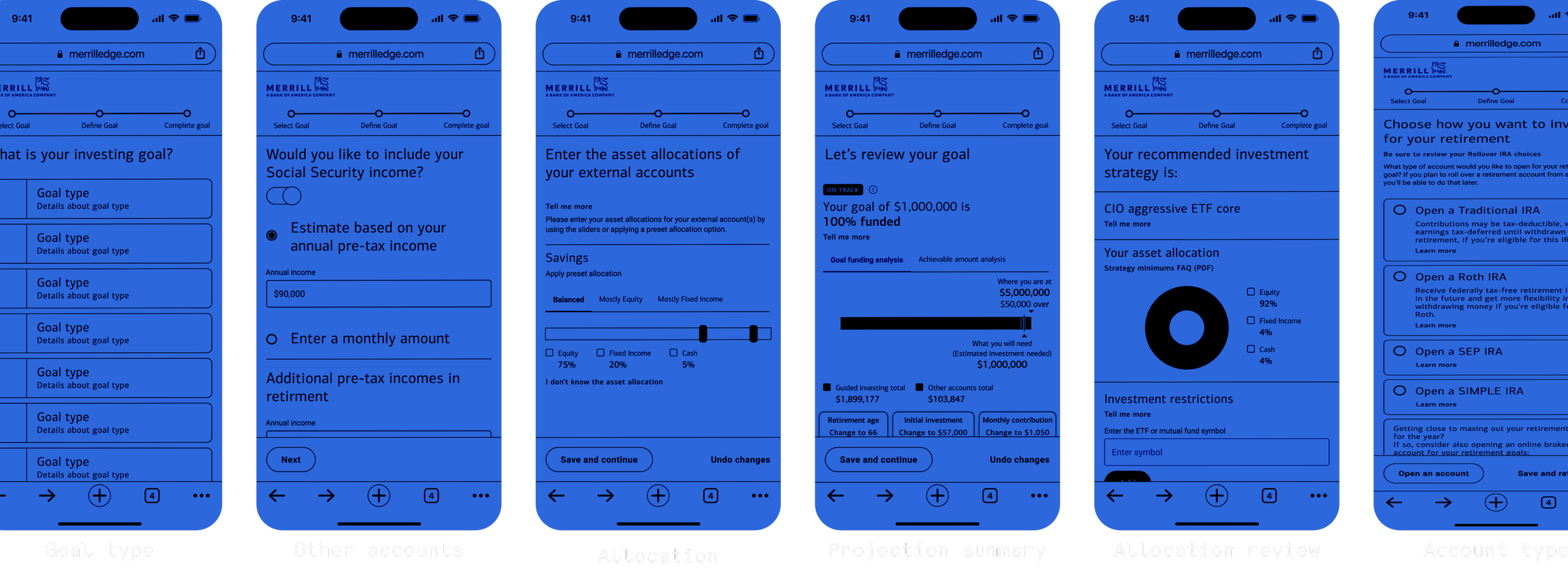

In this role, I led designs for Guided Onboarding and Investing projects, simplifying account setup and goal achievement. Personalized information reduces anxiety in investment decisions; flexibility empowers users to manage their finances without the need for a financial advisor. This is good for financial advisors and consumers, because AI can enable advisors to manage more clients, while the online account creation decreases wait time for users.

I utilized the existing onboarding flow, which previously served to facilitate a phone call between the user and an advisor. Making updates to this flow, The new flow is more dynamic and guides directly to online account creation.

Design principles

01

Customer confidence

Design interfaces that are reliable and transparent, ensuring users feel confident about their investment decisions.

02

Guiding users with honesty

Provide users with realistic projections and insights into the risks and rewards of their investment choices. By offering transparent information, users can make informed decisions aligned with their financial goals.

03

Simplifying complexity

Design interfaces that simplify the investment process, minimizing cognitive load and maximizing usability.

Original user flow

Wireframes

User flow version 1

Yellow:

Expanded content

Red:

New content

User flow final version

Red:

New content

Yellow:

Expanded content

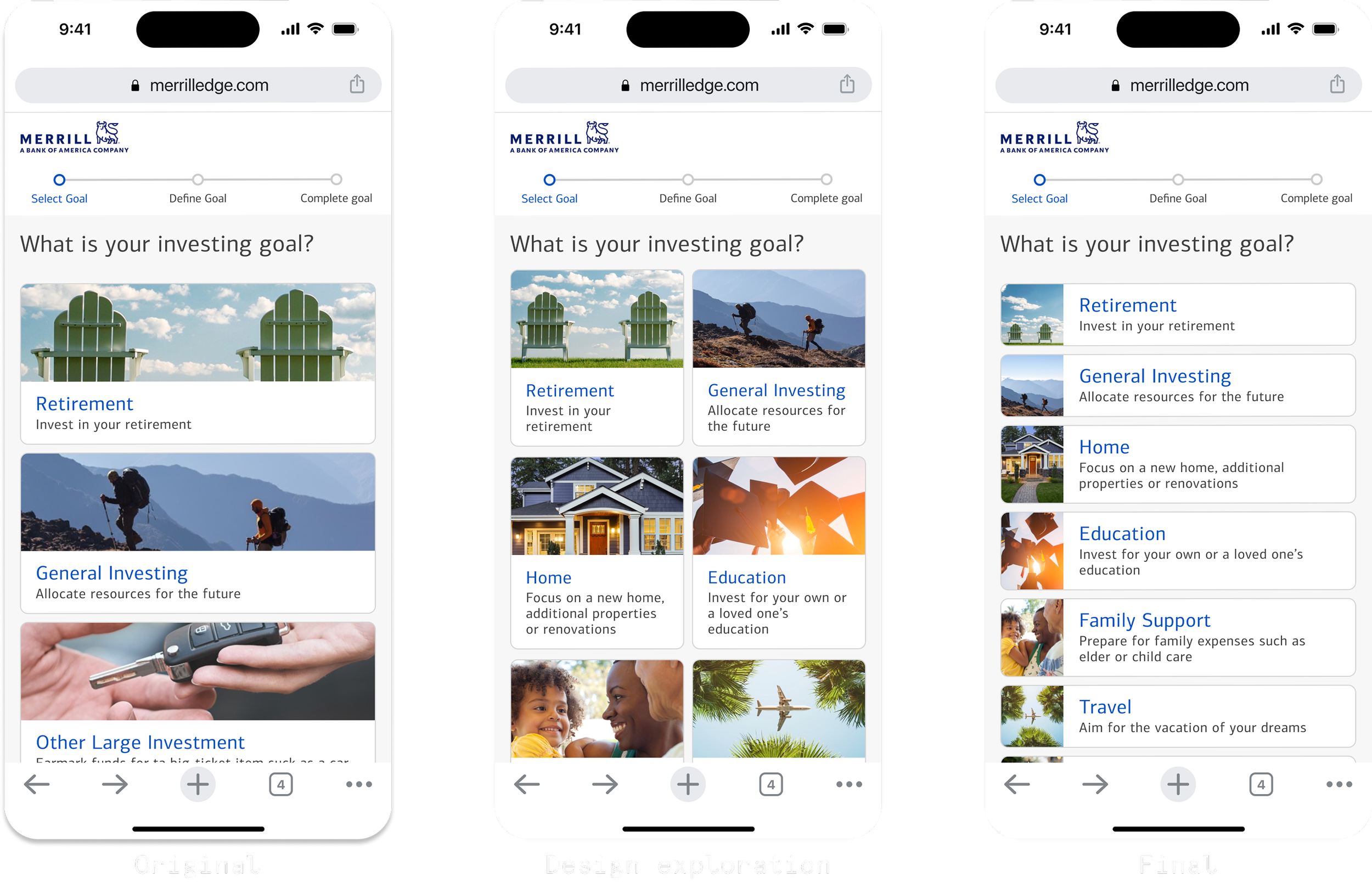

Update highlight 1:

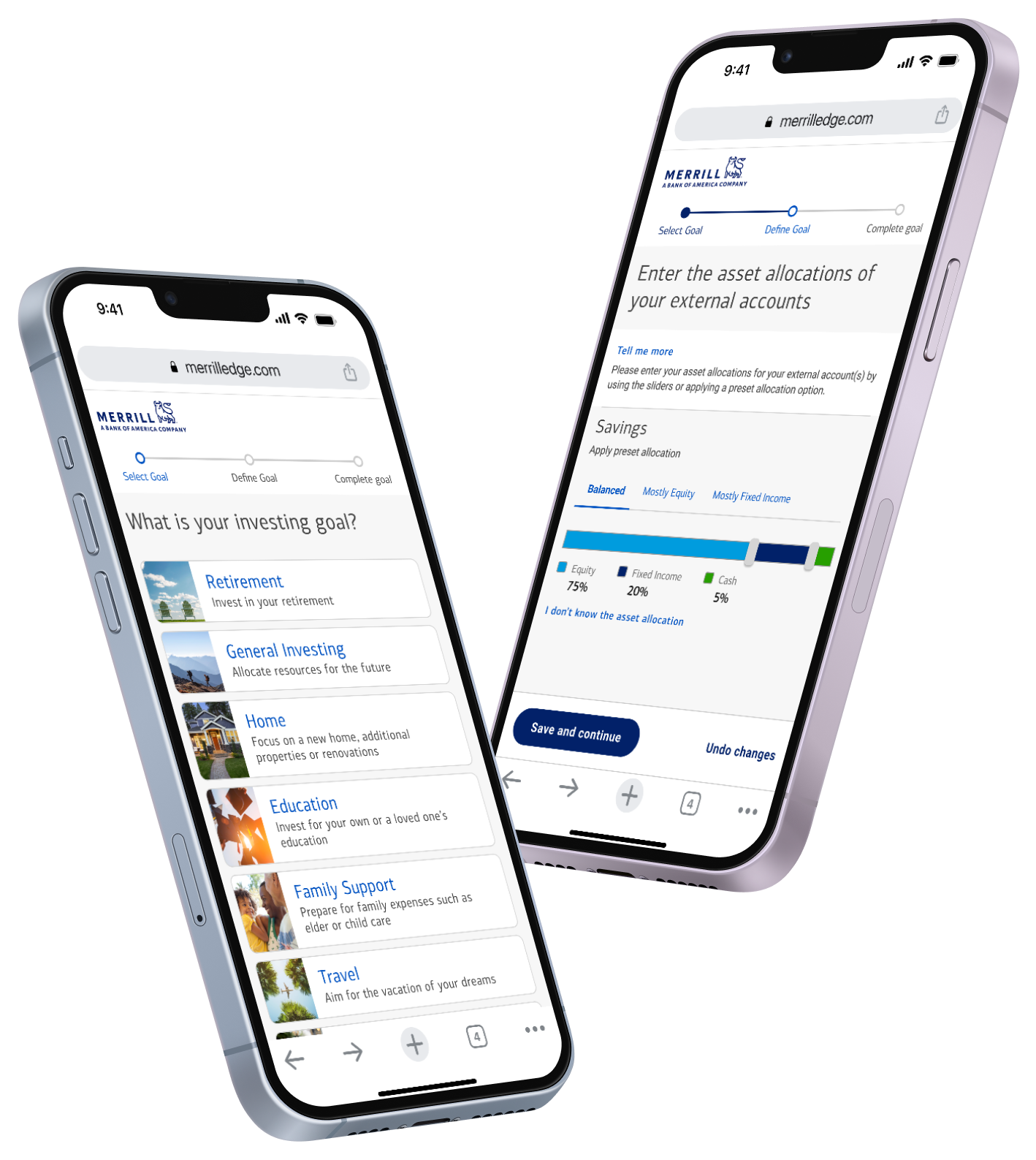

Expanded goal categories

Expanded available goal categories based on user feedback

Customized allocation recommendations and branching flows based on goal category selected

Updated design system card components

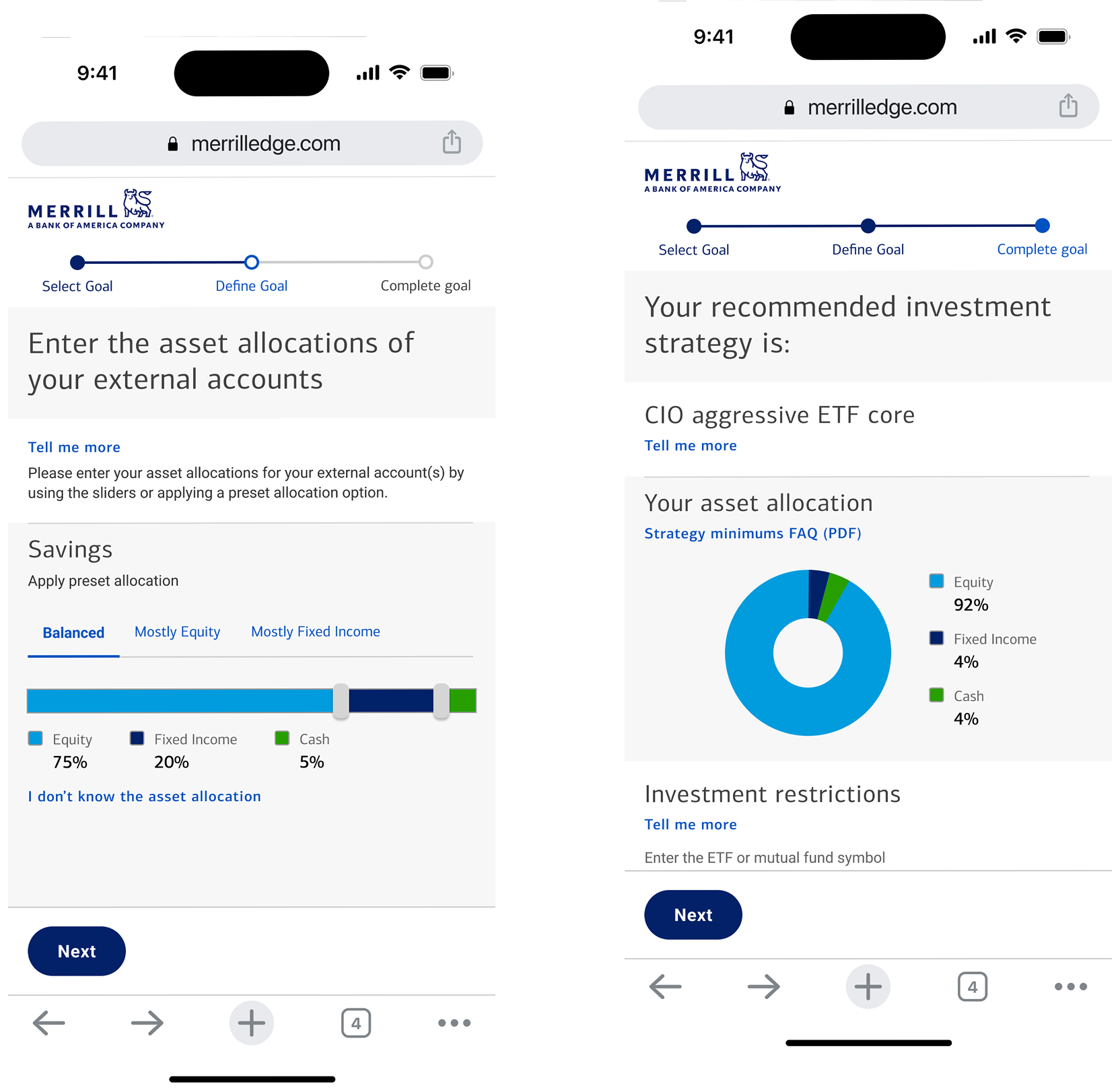

Update highlight 2:

Customizing allocations

Managing the allocation of your retirement savings across different asset classes like equity, fixed income, and liquid cash is important for several reasons, including risk management, time horizon, income needs, inflation protection, and flexibility and adaptability

Customizing asset allocations is a new feature, added only for users who select long-term goals like Retirement

Advanced users can customize this, but a recommended split is set for you by defaultUpdated design system chart components

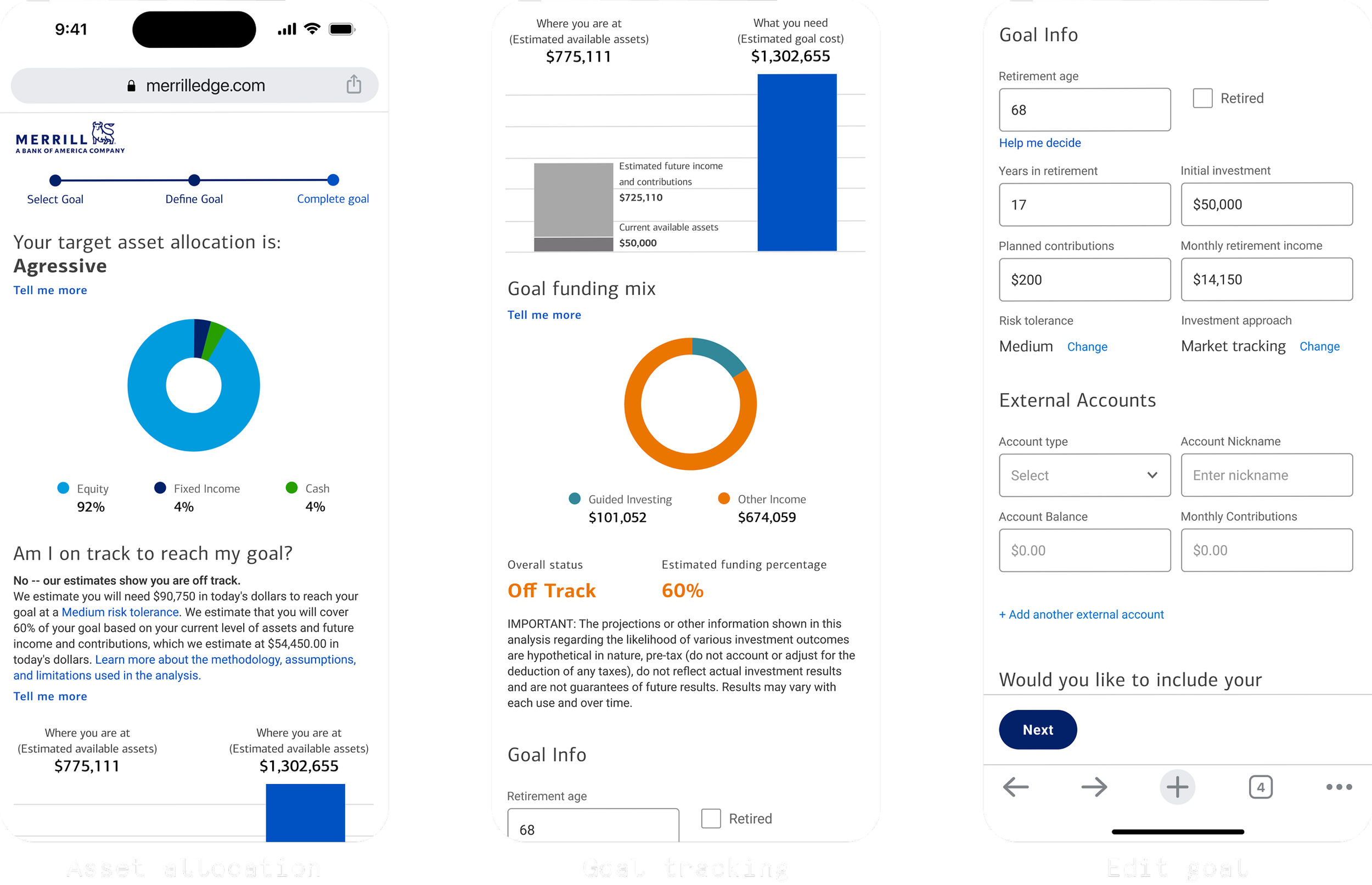

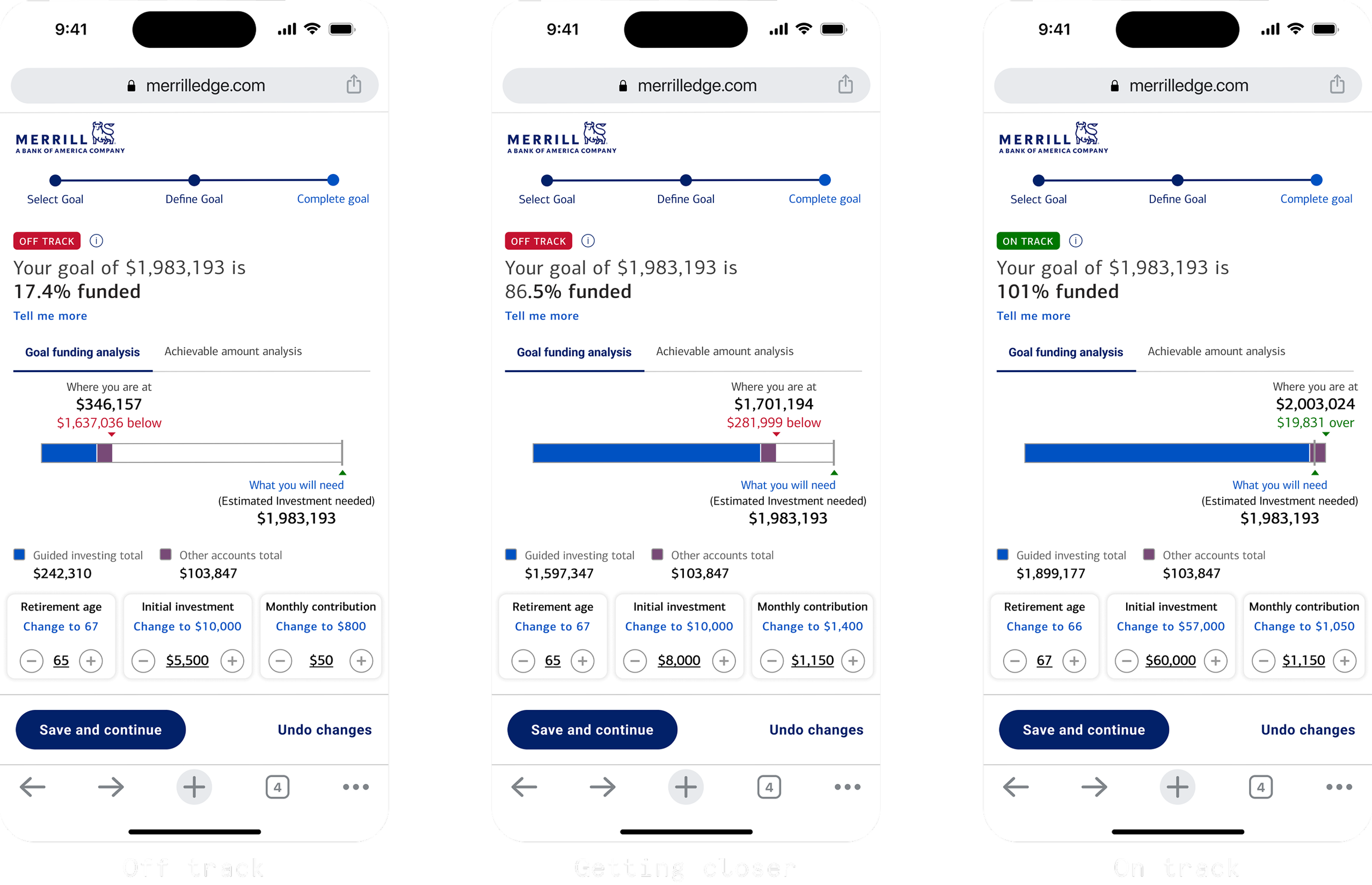

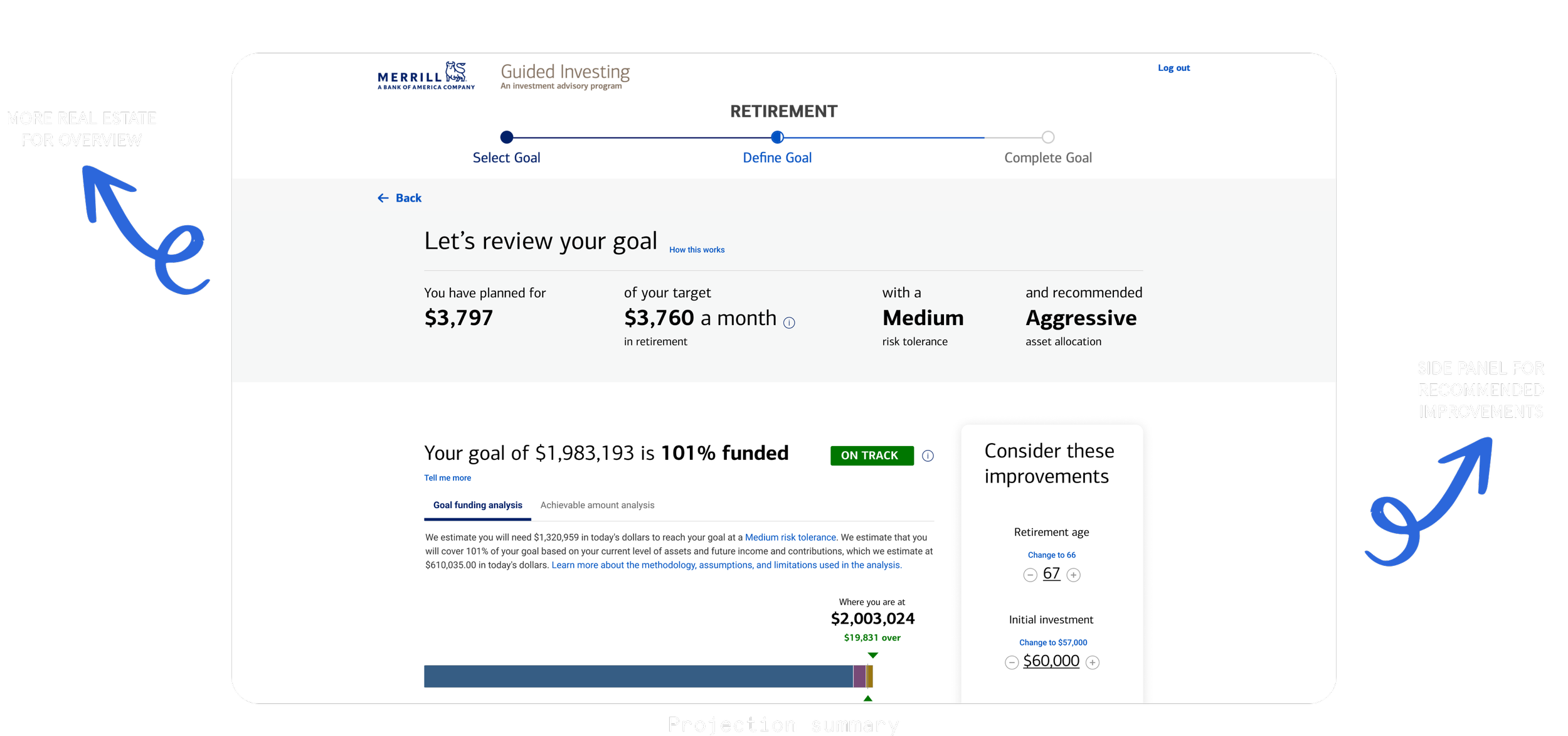

Update highlight 3:

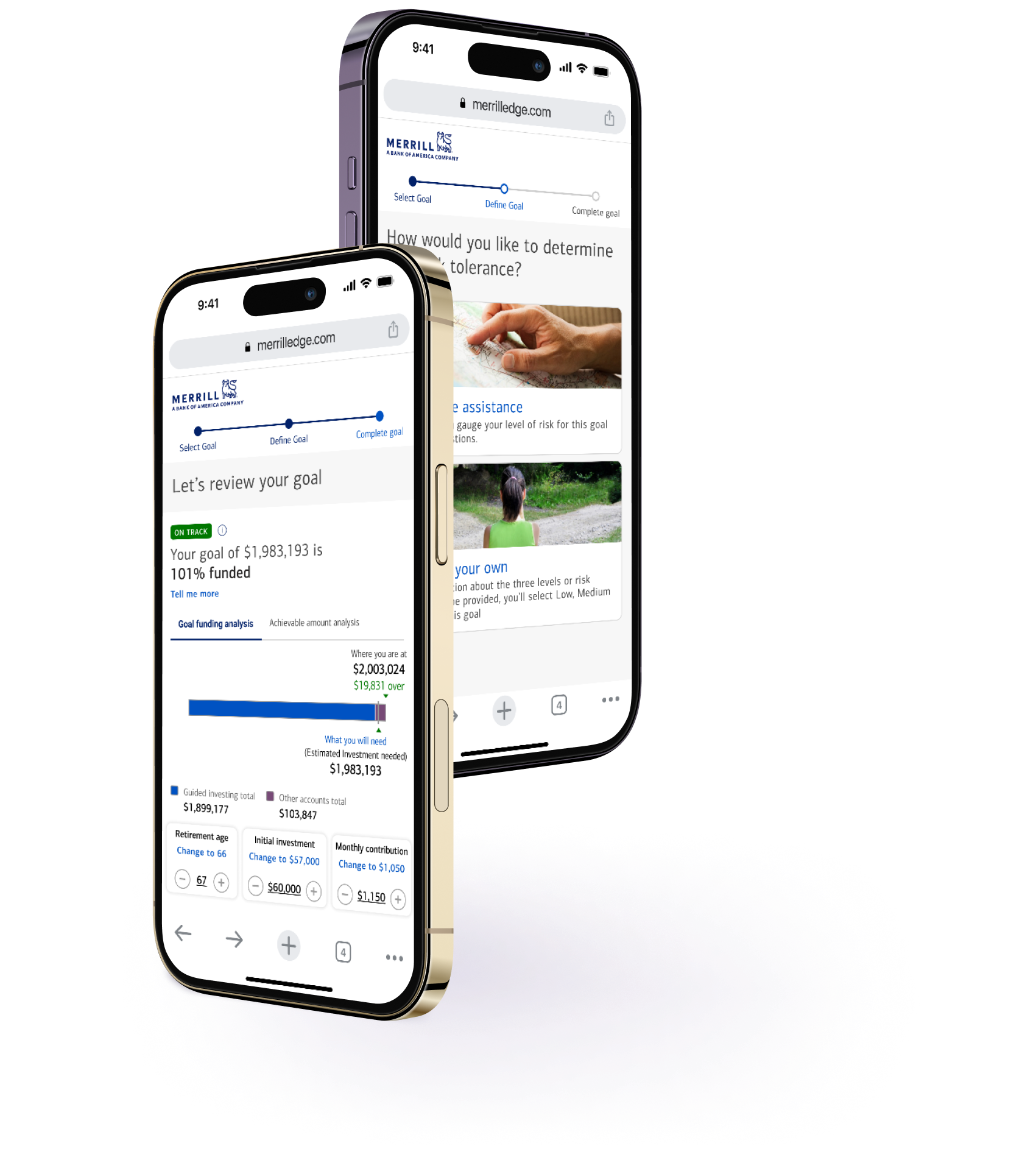

Projection summary page

After a user gets through the onboarding flow, the last step before opening an account is reviewing your asset allocation and goal target

Based on feedback from users and financial advisors, we saw the most opportunity for improvement in this screen

Update highlight 3:

Projection summary page

In design iteration, we tried to make the page feel more interactive and functional- focussing on the goal target and goal editing, and condensing unnecessary information to reduce user confusion

Update highlight 3:

Projection summary page

Redesigned information hierarchy and shortened page height

Condensed graph usage into a stacked bar graph that doubles as a progress tracker

Condensed sections and added tooltips for users who want more information, cleaning up the designs for users who don’tWorked with the legal team to rewrite and reorganize legally necessary copy

Users can now make recommended edits and see how those edits reflect in their estimated fundingWe also added a “Save and Continue” and “Undo changes” bottom navigation option, so users can clearly save or revert editing changes

Collaborated with development after pushback to keep the chart interactive

Original go live: Jun 2020

Launched desktop first and quickly followed with mobile, because data showed a trend of more users creating accounts on mobile

Iterative changes until Feb 2021

Re-engaged with Merrill from August 2021-March 2023 to build out the advisor platform